Health Plan

We know how important good, comprehensive health benefits are. The coverage under the Local 22 Health Plan gives you the security of knowing that you and your family are protected against high out-of-pocket expenses when you need treatment. Here are details on your Health Plan benefits:

Overview of Health Plan Benefits

| Plan | Description |

|---|---|

| Medical | Personal Choice PPO or Keystone Health Plan East (HMO) administered by Independence Blue Cross |

| Prescription Drug | You pay $5 for generic, $10 for preferred brand, and $15 for non-preferred brand at retail pharmacy. Mail order is 2 times the retail copay. Both Benecard CentralFill and Rite Aid retail pharmacies can provide a prescribed 90 day supply of maintenance medication |

| Dental | Dental PPO or Dental HMO (DHMO) |

| Vision | You may receive a vision exam and lenses once every year and frames once every 2 years |

| Laser Eye Surgery | The Plan pays 80% up to a maximum allowable charge of $2000 per eye (maximum reimbursement of $1600 per eye). This is a member-only benefit |

| Hearing Aid | You may receive 100% of the cost of a hearing aid, up to a maximum of $500 per ear, 1x every 5 years. This is a member-only benefit |

| Employee Assistance Program (EAP) | The Plan pays 100% for up to 5 face-to-face visits, per issue, with a trained mental health professional |

| Other Benefits | The Plan provides an advocacy benefit, administered through Health Advocate, to help you and your family members with healthcare and health insurance issues |

| The plan offers telemedicine services (MeMD) that allows you to reach a medical provider via telephone or web 24/7, 365 days a year |

Medical Plan Benefits

Here is a summary of the benefits provided under the PPO and the HMO medical plans. For additional details on any benefit limit or exclusions please contact Independence Blue Cross or the Health Plan Office

| PPO Medical Plan | HMO Medical Plan | ||

|---|---|---|---|

| Plan Feature | In-Network | Out-of-Network1 | In-Network |

| Annual Deductible | $0 per individual | $250 per individual | $0 per individual |

| $0 per family | $500 per family | $0 per family | |

| Out-of-Pocket Maximum | $1,000 per individual | $1,000 per individual | $1,000 per individual |

| $2,000 per family | $2,000 per family | ||

| Lifetime Maximum | Unlimited | Unlimited | Unlimited |

| Physician Services | |||

| Primary care office visit | $15 copayment | 80% after deductible | $15 copayment |

| Specialist office visit | $25 copayment | 80% after deductible | $25 copayment |

| Preventive Care (for adults and children) | 100% | 80% after deductible | 100% |

| Pediatric Immunizations | 100% 2 | 80%, no deductible | 100% 2 |

| Routine Gynecological Exam and Pap test (1 per calendar year for women of any age) | 100% | 80%, no deductible | 100% (no referral required) |

| Mammogram | 100% | 80%, no deductible | 100% (no referral required) |

| Inpatient and Outpatient Services | |||

| Maternity | |||

| First OB Visit | $15 copayment | 80% after deductible | $0 copayment |

| Hospital | 100% | 80% after deductible | 100% |

| Inpatient Hospital Services | |||

| Facility | 100% | 80% after deductible | 100% |

| Physician/Surgeon | 100% | 80% after deductible | 100% |

| Inpatient Hospital Days | Unlimited | 70 | Unlimited |

| Outpatient Surgery | |||

| Facility | 100% | 80% after deductible | 100% |

| Physician/Surgeon | 100% | 80% after deductible | 100% |

| Skilled Nursing Facility | 100% | 80% after deductible | 100% up to 180 days per calendar year |

| Emergency Room | $25 copayment (waived if admitted) | $25 copayment, no deductible, copay waived if admitted | $25 copayment (waived if admitted) |

| Urgent Care Center | $17 copayment | 80% after deductible | $17 copayment |

| Ambulance | |||

| Emergency | 100% when medically necessary | 100%, no deductible | 100% when medically necessary |

| Non-emergency | 100% when medically necessary | 80% after deductible | 100% when medically necessary |

| Outpatient Laboratory | 100% | 80% after deductible | 100% |

| Outpatient Radiology | 100% | 80% after deductible | 100% |

| Therapy Services | |||

| Physical, Speech, Occupational | $10 copayment | 80% after deductible | 100%. Up to 60 consecutive days per condition covered, subject to significant improvement |

| Pulmonary Rehabilitation | $10 copayment | 80% after deductible | 100% |

| Respiratory therapy | $10 copayment | 80% after deductible | 100% |

| Restorative services, including chiropractic care | $25 copayment | 80% after deductible | 100%. Up to 60 consecutive days per condition covered, subject to significant improvement |

| Other Services | |||

| Home Health Care | 100% | 80% after deductible | 100% |

| Durable Medical Equipment | 100% | 80% after deductible | 100% |

| Mental Health Care | |||

| Inpatient | 100% | 80% after deductible | 100% |

| Outpatient | $25 copayment | 80% after deductible | $25 copayment |

| Substance Abuse Treatment | |||

| Inpatient | 100% | 80% after deductible | 100% |

| Outpatient | $25 copayment | 80% after deductible | $25 copayment |

1 Non-Preferred Providers may bill you the differences between the Plan allowance, which is the amount paid by Independence Blue Cross, and the actual charge of the provider.

2 Office visit subject to payment

Prescription Drug Plan Benefits

Here is a summary of your prescription drug benefit. For additional details on any benefit limit or exclusion, please contact Benecard or the Health Plan office

| Prescription Drug Category | Retail Pharmacy | Mail Order * |

|---|---|---|

| Generic | $ 5 copay for up to a 30-day supply | $ 10 copay for up to a 90-day supply |

| Preferred Brand Name | $ 10 copay for up to a 30-day supply | $ 20 copay for up to a 90-day supply |

| Non-preferred Brand Name | $ 15 copay for up to a 30-day supply | $ 30 copay for up to a 90-day supply |

* In addition to Benecard Central Fill, the mail order facility, you can fill presctriptions for your 90-day maintenance medications at your local Rite Aid retail pharmacy

Dental Plan Benefits

Here is a summary of your dental plan benefits. For additional details on any benefit limit or exclusion, please contact Aetna or the Health Plan office

| PPO | DMO | ||

|---|---|---|---|

| In-network | Out of network* | ||

| Annual Deductible | |||

| Individual | None | None | None |

| Family | None | None | None |

| Preventive Services | 100% | 100% | 100% |

| Basic Services | 100% | 100% | 100% |

| Major Services | 100% | 100% | 100% |

| Dental Implants | 100% | 100% | Not Covered |

| Annual Benefit Maximum** | $5,500 | None | |

| Office Visit Copay | N/A | N/A | $0 |

| Orthodontic Services | 100% | 100% | 100% |

| Orthodontic Deductible | None | None | None |

| Orthodontic Lifetime Maximum** | $4,000 | $4,000 | None |

*Out of Network services reimbursed at % of allowed charge. Out of network providers may bill you for the difference between amount charged and amount paid by Aetna.

**Annual and Lifetime Maximums are total of in-network and out-of-network treatment combined

Vision Plan Benefits

Here is a summary of your vision plan benefits. For additional details on any benefit limit or exclusion, please contact VBA or the Health Plan office

| Participating Provider | Non-Participating Provider | |

|---|---|---|

| ROUTINE EXAM | ||

| (for glasses) Once every 12 months | Covered 100% | Reimbursedup to $36 |

| LENSES | Standard Glass or Plastic | |

| (once every 12 months) | ||

| Single Vision | 100% | Up to $32 |

| Bifocal | 100% | Up to $65 |

| Blended Bifocals | 100% | Up to $65 |

| Progressive (except digital) | 100% | Up to $65 |

| Trifocal | 100% | Up to $65 |

| Lenticular | 100% | Up to $65 |

| Polycarbonate (under age 19) | 100% | N/A |

| 2 Yr. Scratch Protection | 100% | N/A |

| UV 400 | 100% | N/A |

| Tints | 100% | N/A |

| FRAME | ||

| Once every 24 months | Covered 100% if within the plan’s wholesale allowance | Up to $40 |

| OR | ||

| CONTACT LENSES | In lieu of all other materials/services* | In lieu of all other materials/services* |

| (once every 12 months) | ||

| Elective Contact Lenses | Up to $160 | Up to $160 |

| Medically Necessary | UCR | Up to $300 |

| (requires prior authorization from VBA) | (usual, customary and reasonable) | |

* The contact allowance is applied to all services/materials associated with contact lenses. This includes, but is not limited to, exam, fitting, dispensing, cost of lenses, etc.

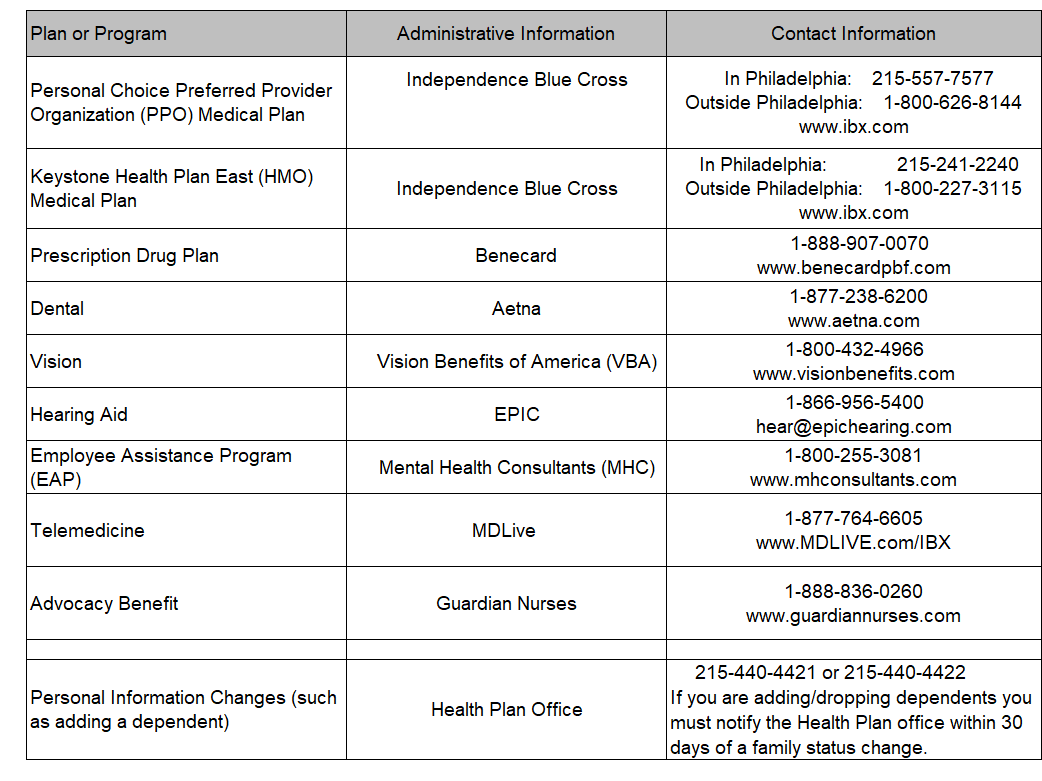

Whom to Call

I.A.F.F. LOCAL 22

THE PHILADELPHIA FIRE FIGHTERS UNION

HEALTH PLAN

SUMMARY PLAN DESCRIPTION